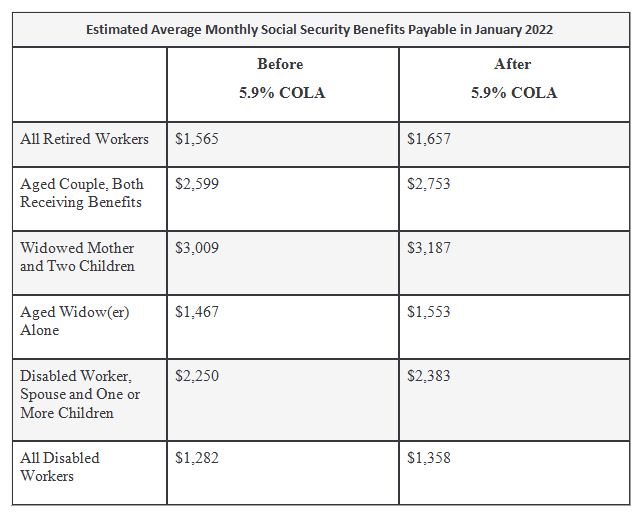

Social security disability insurance will see a 5.9% COLA increase in 2022. This is indeed a welcome news to SSDI benefit recipients for whom disability benefits are the major source of income. The monthly benefit for disabled workers will increase by $76, i.e. from $1,282 to $1,358 a month. When a disability claim is filed with the SSA (Social Security Administration), the applicant has to provide medical evidence that proves the disability and its severity. To determine eligibility, medical chart reviews become an important requirement. At MOS, we assist social security disability attorneys with the medical record review process, extracting the crucial and relevant medical facts and presenting them in an easily comprehensible format. This review of medical records is ideally done at an early stage itself so that the complete medical record set is retrieved from the different treatment providers in time.

The 5.9% increase in the Social Security benefits and SSI (Supplemental Security Income) payments in 2022 is applicable to around 70 million Americans. This COLA or cost-of-living-adjustment is meant to offset the increased costs of goods and services, which is a result of increase in inflation. The SSA has been mailing COLA notices throughout December to retired and disabled beneficiaries, survivors, SSI recipients, and representative payees. This notice is also available online via the Message Center in one’s My Social Security Account.

Source: Social Security Administration

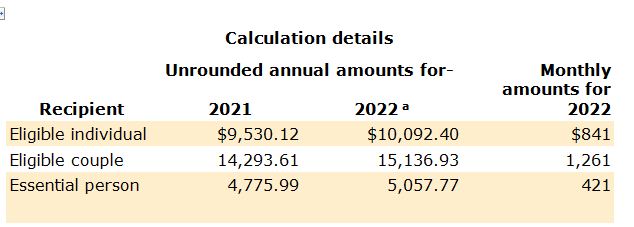

Here is a look at the SSI payment amounts that become effective in January 2022.

The monthly maximum SSI benefit amounts for 2022 are $841 for an eligible individual, $1,261 for an eligible individual with an eligible spouse, and $421 for an essential person. Typically, monthly benefit amounts for the following year are calculated by increasing the unrounded annual amounts for the present year by the COLA effective in January of the following year. The new unrounded amounts are each divided by 12 and the resulting amounts are rounded down to the next lower multiple of $1.

The unrounded amounts for 2022 equal the unrounded amounts for 2021 increased by 5.9 percent.

Source: https://www.ssa.gov/oact/cola/SSI.html

The 2022 COLA is large because the prices of goods and services measured in the CPI-W (Consumer Price Index for Urban Wage Earners and Clerical Workers) have increased considerably in the past year, as a result of the rebounding economy and the COVID-19 outbreaks. Both of these have increased energy prices and pressurized the world’s supply chains.

Increase in Medicare Part B Premiums as Well

Medicare Part B premiums are deducted from most SS retirement payments and therefore most beneficiaries may not see the full increased amount in their checks. For 2022, Medicare Part B premium is $170.10, an increase of $21.60 from $148.50 in 2021. People with the smallest social security benefit would be hit the hardest by this Medicare increase, says Mary Johnson, Social Security and Medicare policy analyst for the Senior Citizens League, a nonpartisan advocacy group. From the year 2013 through 2022, SS COLAs have increased payments by 18.8 percentage points. During this same period Medicare Part B premiums have increased by 57.2 percentage points, according to the Senior Citizens League statistics.

SS beneficiaries, social security attorneys, disability attorneys, and medical claims review companies stay updated with the changes introduced to social security benefits. It is important to know the eligibility criteria for social security disability benefits so that processes such as medical records review are carried out in time to determine whether the disability claim is a valid one.