People with disability who are unable to work may receive wage replacement benefits from an insurer. To claim the benefits, the disabled person has to undergo a medical evaluation to ascertain the disability and its degree. However, the major concern of disability carriers is compliance with the amendments in Employee Retirement Income Security Act (ERISA) which came into force on April 1, 2018. Thenceforth, Section 503 of ERISA ensures that the disability claimants receive eligible compensation through an accurate and fair medical chart review process. Medical review solutions assist disability carriers to conduct quality medical evaluations and clinical reviews. This blog intends to give the main types of medical evaluations with regard to the new requirements of ERISA.

Interested in a custom medical chart review?

Disability Evaluation through Medical Chart Review

Disability evaluation is defined as the assessment of the disability of the claimant to know its extent and impact on the quality of life and the ability to do work. This aids the disability carriers to provide eligible work replacement benefits to the claimant. To be deemed as disabled, the impairment of the claimant must be profound so that it considerably reduces the movement and senses of a person. The medical claims review should help establish the medical necessity of the treatments provided to the claimant.

Clinical and Medical Expertise Mandatory to Evaluate Disability

The extent and severity of the disability are probed and confirmed by insurance companies as part of their claim determination process. Medical chart review thus becomes an important consideration. The confirmation of the coverage is added in almost all the policies, enabling insurers to request a medical evaluation. After the implementation of the ERISA rule, the claim determinations are not arbitrary. Instead, with the right expertise of the physicians and clinicians, the medical condition that restricts the claimant’s ability to work is evaluated. Medical peer review ensures that the physicians performing the evaluation have unrestricted credentials pertaining to medical licensure and medical board certifications.

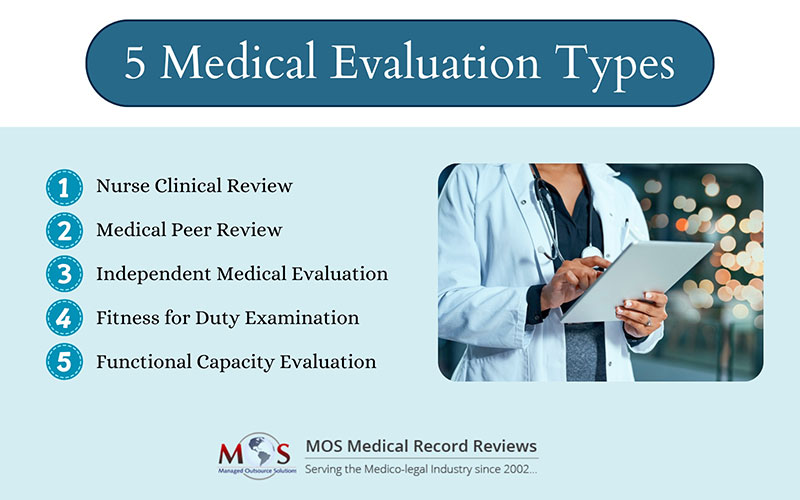

Main Types of Medical Evaluation

Nurse Clinical Review: Disability associates of the carrier request a nurse clinical review to assess the medical condition of the claimant. In these file-based reviews, the medical records of the claimant are analyzed by the nurse to discover evidence that confirms the functionality, restrictions, or limitations. The attending physicians are contacted for obtaining additional information or to clarify specific areas of the claim. If the nurse is not convinced by the opinions written in the file, a peer review can be requested.

Medical Peer Review: This medical evaluation is also paper-based and similar to that of a nurse clinical review. However, the review is performed by a physician who has credentials equivalent to that of the attending physician. In some situations, a “peer-to-peer” consultation is required in a peer review which has to be authorized by the insurance company. Peer-to-peer review can be an added benefit for securing valuable perspectives for both the peer reviewer and the attending physician. Based on the claimant’s restrictions and functionality, the peer physician gives the medical opinion. The review documents the clinical reasoning on the basis of which insurance carriers deny or accept the claim.

Independent Medical Evaluation: Independent medical evaluations also address the same issues as that of peer review. The main difference lies in the fact that the in-person medical examination takes place in addition to the review of the medical records. In the case of IMEs, it is important that there is a nationwide network of examining physicians as they should be available in specific geographic locations.

Fitness for Duty Examination: This type of medical evaluation is job-related wherein the employer demands a medical evaluation. This helps employees to determine whether he/she is able to meet the minimum required criteria to complete a job safely and minimize the risk of injury. It also gives an understanding of the impairment and its reaggravation. After the evaluation of the disability through fitness for duty examination, employers can detain the employees from doing certain work that might pose risk to the present health condition.

Functional Capacity Evaluation: They are a set of tests that determine the physical capabilities of the claimant. It compares the claimant’s present health condition, vital signs, and body structures to the requirements of potential jobs and work environments. Therefore, the core purpose of the functional capacity evaluation is to find the claimant’s ability to participate in work. However, the claimant’s health condition to do other activities of daily living and support work performance are also analyzed.

Understanding the Final Regulation of ERISA

As a company providing medical review solutions to insurers and insurance attorneys, we understand that the claim procedures outlined in Section 503 of ERISA mandate insurance carriers to provide the claimant with a full and unbiased review of the claim.

If a disability claim is denied, it has to be effectively communicated with a written notice.

The new procedural regulations are aimed at shielding the claims from any conflicts of interest and providing a reason behind a decision.

Key Requirements of the Final Regulation of ERISA

- Disclosure Requirements

The denial notices must specify the reason behind why a plan denied a claim by attaching a complete discussion. It should also mention the standards that have been used to arrive at this decision.

- Right of the claimant and internal protocols

The benefit denial notice must contain a statement that the claimant is entitled to receive the entire claim file and other related documents upon request. This also includes reports obtained from medical evaluation and clinical review teams. The internal rules, protocols, and standards or other conditions or criteria pertaining to the claim denial have to be mentioned in the denial notice.

- The right of the claimant to respond to new information prior to a final decision

If there is new or additional evidence or rationales regarding the disability claims, the claimants must be given a fair chance to respond to them prior to a final decision.

- Preventing Conflicts of Interest

The insurance plans have to make certain that the disability benefits and claims are designed in a manner such that it upholds the impartial and independent nature of the parties involved in making the decision.

- Exhaustion of the claims and appeal process

If the plan adheres to all the claims processing rules, the claimant is considered to have exhausted the administrative remedies available under the plan. In such circumstances, the claim or appeal is deemed denied. The claimant has to file a lawsuit to claim the benefits in federal court.

- Determination of disability

Any misrepresentation of facts or errors in the application for coverage is considered adverse benefit determinations. Disability carriers have to partner with a medical record review service company to provide clinical and vocational expertise to navigate through the complex issues arising from disability determinations.

The medical evaluation requires a thorough medical records analysis to understand the degree of disability and the impact of impairment on the claimant’s ability to do work. The vocational experts in medical record review companies have the demonstrated capabilities to ensure a credible and unbiased evaluation of disability claims.

Benefit from dedicated medical review solutions.