Workers’ compensation is a beneficial program, designed to protect employees in the event of work-related injuries or illnesses. Understanding the key aspects of this program is essential for both employers and employees. This beneficial program for workers is administered at the state level in all fifty states, Puerto Rico, the District of Columbia, and the U.S. Virgin Islands with each state having their own program. Since medical records are a crucial factor when determining benefits, medical review services have an important role to play.

Each U.S. state has its own mandates for their workers’ compensation program. The minimum and maximum weekly rate benefits, and how to calculate that for payment to an injured employee are determined by individual state laws.

From thorough chart reviews to precise documentation analysis, we handle everything with the utmost accuracy!

Workers’ Compensation Program Facts

-

- Mandatory coverage: Workers’ compensation is mandatory in many jurisdictions. Employers are typically required by law to provide this coverage for their employees. It’s important for both employers and workers to be aware of their rights and responsibilities under this program.

-

- Coverage for work-related injuries and illnesses: This program provides coverage for injured workers’ medical costs, and lost wages. This includes accidents at the workplace, occupational diseases, and injuries sustained while performing work. It may also cover death and funeral benefits, if required. A three to seven-day waiting period is involved before the benefits begin.

-

- No-fault system: One distinctive feature of this program is that it operates on a no-fault basis. Injured employees are generally entitled to benefits regardless of who was at fault for the accident. This helps expedite the compensation process and avoid lengthy legal battles.

-

- Reporting requirements: Timely reporting of workplace injuries or illnesses is crucial. Employers should establish clear procedures for reporting incidents, and employees should promptly notify their supervisors about any work-related injuries. Failing to report promptly could jeopardize a claim.

-

- Medical examination: Injured employees may be required to undergo a medical examination as part of the workers’ compensation process. This examination helps determine the extent of the injury, the necessary treatment, and the potential for returning to work.

-

- Dispute resolution: Disputes can sometimes arise between employers and employees regarding workers’ compensation claims. Most jurisdictions have established mechanisms for resolving these disputes, such as mediation or appeals to a workers’ compensation board.

-

- Return-to-work programs: Many workers’ comp programs encourage and support return-to-work initiatives. This may involve modified duties or a gradual return to full-time employment, depending on the nature and severity of the injury.

-

- Legal assistance: In cases where disputes are complex or claims are denied, seeking legal advice is advisable. Workers’ compensation laws can be intricate, and legal professionals specializing in this field can provide valuable guidance.

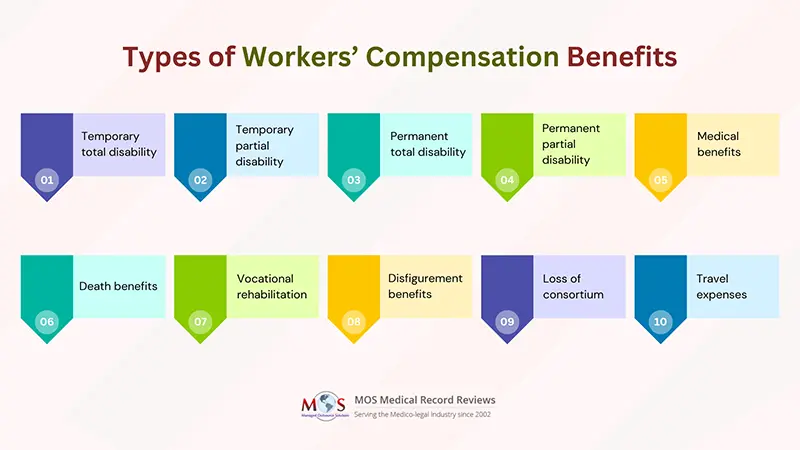

Comprehensive Overview of Workers’ Compensation Benefits

-

- Temporary total disability: It will cover around two-thirds of a worker’s pre-injury wages until the worker returns to work. When the worker resumes work, the benefits end.

-

- Temporary partial disability: Workers who return to work with reduced responsibilities on account of their injury and a lower salary receive this type of benefit. It helps make up for the loss in wages.

-

- Permanent total disability: This benefit is paid to a worker, whose injury results in permanent impairment or the worker has reached his/her maximum for medical improvement for the injury. Only few workers’ comp claims result in permanent total disability benefits.

-

- Permanent partial disability: These benefits are usually limited to a particular period or total dollar limit. It is paid to an employee who has permanent impairment that does not completely limit his or her ability to work. It is paid until the worker has achieved maximum medical improvement.

-

- Medical benefits: Only medical benefits are paid to workers whose cases do not extend beyond the 3 to 7 day waiting period.

-

- Death benefits: Paid to the dependents of a deceased worker, this compensation is based on a formula that calculates the worker’s earnings and the number of dependents who are determined to be eligible survivors.

-

- Vocational rehabilitation: Assists injured or ill employees in returning to work by providing job training, education, or placement services. This benefit aims to help individuals regain their employability after a work-related injury.

-

- Disfigurement benefits: Compensates employees for visible and permanent disfigurement or scarring resulting from a work-related injury. The amount may vary based on the severity and location of the disfigurement.

-

- Loss of consortium: Some jurisdictions allow spouses or family members to claim compensation for the loss of the injured worker’s companionship, support, and services due to a work-related injury or illness.

-

- Travel expenses: Reimburses employees for reasonable and necessary travel expenses related to medical treatment or vocational rehabilitation.

What Are the Eligibility Criteria to File a Claim?

- The employee must be working in the company where the claim will be filed.

- The employer must have a workers’ compensation insurance program in place for their employees.

- The injury or illness must be a work-related one.

- The worker must report the injury and file a claim in compliance with the state’s deadlines for doing so.

Role of Medical Chart Review in Determining Workers’ Compensation Eligibility

Determining eligibility for workers’ compensation benefits is paramount to ensuring fair and accurate assessment of an employee’s claim. Medical chart review constitutes an important preliminary step in determining eligibility. Medical charts serve as comprehensive records of the injured worker’s medical history, diagnosis, treatment plans, and progress. Skilled professionals, often including physicians or nurses specializing in workers’ compensation cases, review these charts to evaluate the relationship between the reported injury or illness and the individual’s work activities. This process helps establish causation and the extent of the disability, providing crucial insights into the eligibility for various benefits such as medical treatment coverage, temporary or permanent disability benefits, and vocational rehabilitation services. The medical chart review acts as a crucial tool in establishing a clear link between the work-related incident and the resulting health condition, facilitating fair and informed decisions in the workers’ compensation claims process.

Simplify the complexities of Workers’ Compensation claims with dedicated medical record review services!