Insurance defense paralegals are vital members of a legal team handling insurance litigation. Their work is quite fast-paced with little time to spare amidst complex and challenging legal questions. Often, paralegals are entrusted with case management that involves keeping track of documents, deadlines and calendar entries. He/she will have the responsibility to track the time when the insurance company has to respond to the plaintiff’s petition. Paralegals will have to ensure that the insurance company and the insured entity are willing to produce the relevant records for close scrutiny and review.

Among the documents that paralegals need to retrieve and evaluate are medical records, case files and manufacturer’s warnings. These have to be reviewed and summarized. For that matter, paralegals need extensive knowledge of medical terminology and medical procedures. Insurance defense litigation paralegals are typically required to prepare a chronology of medical records of the claimant. This is where they can make use of professional medical review services. They can rely on a professional medical review company that provides services such as medical record organization, medical case chronology, and medical case history and summary. Such services lighten the workload of paralegals, giving them more time to focus on trial preparation and other important tasks.

Gain a competitive edge in insurance defense litigation!

Benefit from specialized medical record review assistance!

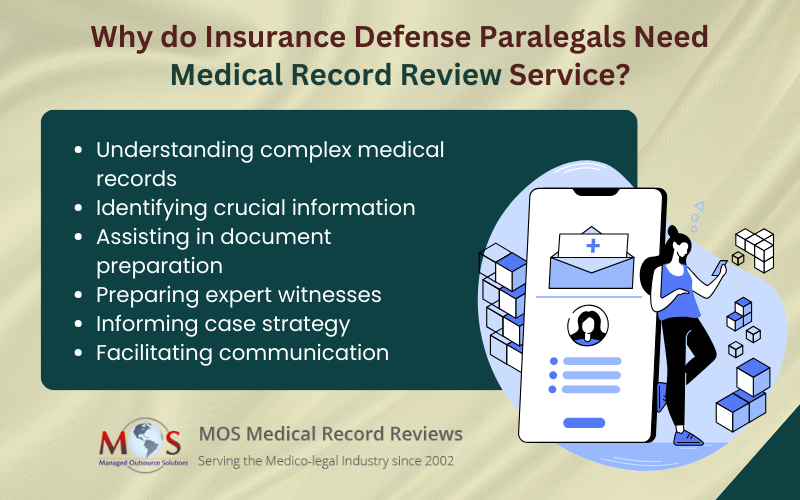

Major Reasons Why Insurance Defense Paralegals Require Medical Record Review

Insurance defense paralegals require medical review services for several reasons:

- Understanding medical records: Healthcare records can be complex and difficult to decipher for those without medical training. Paralegals need to understand the medical history, diagnoses, treatments, and prognoses of the parties involved in a case. Medical review services help them comprehend these records accurately.

- Identifying relevant details: In insurance defense cases, medical data plays a key role in determining liability, damages, and the extent of injuries. Accurate review of healthcare reports can help paralegals identify pertinent information within medical records that may impact the case outcome.

- Preparing legal documents: Paralegals often assist attorneys in preparing legal documents, including pleadings, motions, and discovery requests. Medical record analysis provides them with the necessary medical context to draft these documents accurately and effectively.

- Expert witness preparation: In some cases, expert witnesses, such as medical professionals, may be called upon to testify. Paralegals need to work closely with these experts to prepare them for trial or deposition. Medical review services can aid in preparing comprehensive summaries and exhibits for expert witnesses.

- Case assessment and strategy: Understanding the medical aspects of a case is crucial for developing effective defense strategies. Professional review services can help the legal team assess the strengths and weaknesses of the medical evidence.

- Communicate with healthcare providers: Paralegals often need to communicate with healthcare providers to obtain additional information or clarification regarding the medical records. Having a solid understanding of medical terminology and concepts facilitates effective communication with these providers.

Paralegals are also in many cases entrusted with the duty of identifying expert witnesses. For this, paralegals have to peruse medical journals and depend on online resources. Often, they will have to interview these people to determine whether they can be chosen as expert witnesses. Reliable medical review firms can also help with trial preparation by providing services such as identifying and assembling trial exhibits. Proper review of medical records helps insurance defense paralegals to understand the complex medical aspects of cases and support attorneys in providing the best possible defense for their clients.

Optimize your trial preparation process with our reliable medical review services.

Get a Free Trial!